Why Worthwhile?

-

A Meaningful Life is one spent building Worthwhile projects by a Right Plan that leads to a sustainable society.

-

The Right Plan is the one whose ends, means, practical thinking and purposeful action result in a Good Life. A life full of things you need – and not necessarily a life full of everything you want. With a little luck, goods in body and soul, and by making a habit of good choices that reflect moral virtues of temperance, courage, and justice, a Good Life should be sought and found.

WHY WORTHWHILE?

Why Worthwhile?

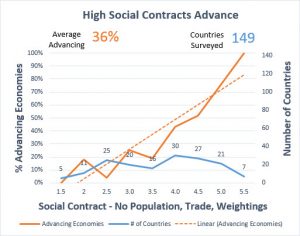

Internationally, the average economy in 207 nations worldwide loses $4 billion a day to our global mature capitalism. With inflation, the rising costs of living lowers incomes, reduce opportunity, and stall economic growth (see SCP at http://csq1.org/SCP).

High-scoring Social Contract nations build strong economies – and low-scoring nations stall and collapse into social problems, instability, and also revolutions and wars.

Finance makes new opportunities possible but when investment boards harm economies unintentionally with tactical asset consolidations and trickledown, whole economies falter as new financing opportunities are reduced and risk is added to all investments long term.

Worthwhile’s Public Utilities are designed to build strong economies by supporting strong social contracts in a targetted, evergreen, low-risk, and inexpensive approach.

By coordinating assembly lines that ensure abundance in the basic things that everyone needs – nationally and around the globe, we build strong Social Contracts cost-effectively – enabling the freedom that is needed for citizens to innovate and to create commerce , trade, and prosperity.

Resetting monetary system economies in this way is timeless best-practice.

Public Utilities in food, housing, basic goods, and healthcare made countries self-sufficient for a fraction of the cost of welfare. Government welfare investments go straight back to the economy, which is good, but welfares seldom match the cost-of-living so they do not solve inequity problems that stall economies. Add to this, the fact that they are unpopular with democratic voters who are untrained in sustainable .

Our think-tank’s submissions to the United Nations and global economic councils – like W.E.F., Davos made it very clear that these are political marketing – and tactical security organizations exclusively. For strategic planning, groups like UNDP have no mandate and no capabilities beyond a basic marketing role.

Worthwhile Industries reformats an initial United Nations-led thesis called WP Projects, to permit the Finance Industry to lead the projects that make economies sustainable again – in profitable win/win investment opportunities.

70% of 220 economies globally are collapse-trending today, and that fact does not create a healthy investment landscape long-term, nor even short-term – as we see today.

Unlike other very famous goto Private Equities that tie trillions of commercial investments to Private Real Estate, usury and socially-irresponsible short-term thinking, and social contract harm, Worthwhile Ventures always build solutions that create strong social contracts and economies.

“History” records great events in time, just as “Philosophy” chronicles great thinking in time. Aristotle called the American Dream a “Good Life” 2500 years ago, and then he went on to explain that a “Meaningful Life” was one spent building worthwhile projects by a Right Plan that brought about Good Lives in a sustainable society.

Philosophy – confirms the benefit of thesis-based investment very well.

Research – confirms that wealth distributions of just 10%, can boost growth by up to 50%. When a country has what it needs in abundance; when it is self-sufficient and is generating strong export revenues, you will find the economy of America or Canada in the very early 1970s or Norway, the Netherlands, Denmark, UAE, or Ireland today.

When people have what they need, they can spend with confidence, and they can be productive – in statistics like Export per Capita.

Worthwhile Campuses build all of these basic needs of a Good Life based on a data-driven 80/20 rule. Abundant food, shelter, education, energy, healthcare, clothing, basic goods like housewares and furniture, transportation; construction; these are the industries that build opportunity, prosperity, and Good Lives.

Campus or no Campus

Worthwhile Ventures CAMPUSes finance nine to sixteen EconomyTech companies as needed to build the assembly lines and supporting delivery tools needed to reach everyone reliably.

FoodBots, PharmaBots, DeliveryBots, and others are entirely standalone, individual national and international companies and Brands.

Investors can own individual companies and still participate in Campus benefits as provided by our growing network of Strategic Partners and Economic Development Teams too.

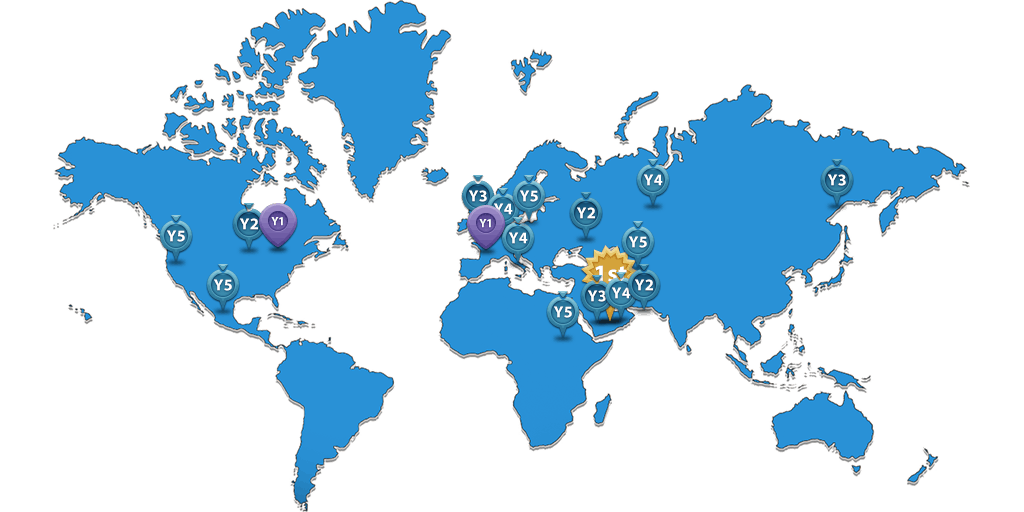

CAMPUS companies target 70% of a GDP’s commodity markets, they build 600 jobs Year-1, and they share resources across companies, industries, and other CAMPUSes in other nations, as needed to reduce risk and a typical robotics-company Return-on-Investment (ROI) – from a typical 7-year time-frame, down to just 20-months in many cases.

Individual Worthwhile Ventures CAMPUSes create flexible Private Equity offerings with 20% annual average sustainable gains and a 20-month ROI – which is based on solid 20-30%-profit operating revenues and a Smart Revenue Ramp-up SRR Risk Mitigation Strategy. The milestone of >$20M EBITDA is reached in early Year-2.

Our returns and gains estimates assume that none of our companies will reach IPO (Initial Public Offerings) before Year-5. This might be a pessimistic estimate, however, as the Robotic and Autonomous Delivery Private Equity and IPO marketplaces are trending – which means that our Patents and IP may attract public interest sooner.

Normal capitalization planning permits us to miss cash-flow targets almost four-times without impacting our 20% annual Gains estimates. It should also be noted that i) our management team have a track record that hasn’t missed targets in $2-billion annual technology delivery organizations for 20-years; and ii) none of our industry sectors have failed to produce multi-billion-dollar valuation-companies. If any one of Worthwhile CAMPUS companies reach a two-billion-dollar capitalization within five years, our 20% annual gains estimates multiply three-times.

WHY NOW?

Why Now?

For three reasons:

First – We need strong economies again. The mix of a mature nuclear era and unsustainable inequality levels worldwide, demands a smart correction and rebalancing because our last two inequality peaks in 1890 and 1930 created international revolutions, WWI & WWII. Investment houses that make low-impact or socially harmful investment decisions only make this situation worse – especially when high-impact, high-profit Private Equity and SEED Investments are also available.

Worthwhile Industries CAMPUSes build strong economies through self-reliance and export diversity while lowering the cost of living and renewing Good Lives and Freedoms

Second – Technology has advanced sufficiently to build the robotic assembly lines needed to ensure our basic needs of life cost-effectively. Government Policy that supports this change (see MEMS) is the second half of a strategic “Right Plan” needed to correct economies with these technologies now.

Third – We have a Right Plan Architect again. For the first time since Buckminster Fuller architected his World Plan in 1980, Worthwhile Industries offers a workable hi-tech engineering plan, the financial vehicle (Funds), and proven government policies that support our sustainably performance managing successful economies and Good Lives internationally

Impact Investing

Worthwhile Smart Cities are based on a “Right Plan of Worthwhile Projects that build a Good Life” (Aristotle, Politic 322 BC) – and they also meet the UN’s Sustainable Development Goals and MENA’s Vision 2030 Oil-Free Economy needs; and sooner than 2030. as well.

Building a Great Future

Alan Turing’s 1943 Universal Machine began a 75-year era of digital automation that is as promising as it has been disruptive. Similar to labor disruptions created during past technology advances like the automated loom and Bessemer steel process automation, our Governments are uncertain again today regarding how to support citizens through a steady barrage of job losses. At the same time, the benefits of computer automation are undeniable.

Strategic Planning discussions often conclude that if we do not “shoot where the duck will fly”, and develop self-sustaining automation today, then we will find ourselves purchasing automated imports from China, Germany, and others within five years – and we see this already today.

No other country will spend more for our lower-quality exports – until the failure of our exports has a devastating, destabilizing economic impact similar to the USSR’s 1986 Economic Collapse. In a global monetary system, countries must be self-sufficient and they must also monetize their economy by creating export wealth. Failing both risks economic collapse.

To solve these critical problems, CSQ Research – our guiding Think-Tank, compared the production, debt, and trade stats of 180 countries and found that 72% are in a collapse-trending today (a “collapse-trending” indicates debt and trade deficits). Analyzing the policies and economies of the other 28% of “Advancing” nations is a study of sustainable, empirically proven-successful policy – scientifically speaking. Here is what we learned.

Countries with high ExCaps very rarely have economies in a collapse trending – and people live well. The Netherlands’ ExCap is $33,600, Canada’s is $13,300, and the US’s is $5,100. The US and Canada are Collapse-trending; Holland is Advancing. When corrected to Holland’s ExCap levels, Canadians would earn $630 billion in new exports annually – that’s a 250% increase in today’s exports. The U.S. side-steps $8 trillion annually by this calculation, and the U.K. loses $1.5 trillion. China’s Economy is Advancing with low ExCap, but their brilliant, Herculean 30-year plan to lift 1.3 billion people out of the stone-age, still showcases a standard of living for the average citizen that would be a steep step backward for G7 nations; low-ExCap, low-opportunity, plus high-inequity was the pervasive economy of a 1000-year medieval dark-age. (Find the stats that we used at http://csq1.org/forums/topic/middle-class-for-power-49-percent-for-prosperity/and http://csq1.org/forums/topic/the-business-case-for-guaranteed-incomes/).

The discussion casts into sharp relief the very high cost of inequality levels that prevent a highly productive population. For Canada, $630 billion in new country-wide export revenues makes a compelling Business Case for the 1/4th lower-cost social supports, and automation that supports a Good Life, at a fraction of the cost, and new export wealth while we sleep.

With community automation in basic needs of food, housing, energy, and essential goods, Citizens are self-sufficient; they can live good lives that will be little disrupted by economic ups and downs. Automating communities reduces the need for Import spending, it creates exports that citizens can sell, and this approach also enables incomes to be sustained away from overcrowded cities and housing bubbles; this prevents inflation, which protects pension values while reducing inequity; and this strengthens democracy’s sustainably too.

Without these automations, and supporting policies, an Economy can not be self-sufficient, so it will need more Imports as it struggles to sell its exports in an increasingly higher-quality, lower-cost international marketplace. As Trade Deficits and Collapse-trendings accelerate, we have few options.

Industry – builds this export Economic Injector at the same time that it builds cost-of-living reductions & import reductions too. Our Exports, similar to Germany-owned VW, build robots (automated assembly lines) that build robots (autonomous cars, autonomous lumber farms, etc.) that create high-quality exports and new wealth (http://www.zerohedge.com/news/2015-09-22/why-volkswagen-systematically-important-germany-and-europe).

Worthwhile’s automations adhere to:

- #WPProjects’ list of the 250 technologies needed to create automated communities (see http://csq1.org/world-peace-transition-projects-faq/) and

- Transition Economics’ TEMature Policy: (http://csq1.org/transition-economics-maturity-model/#TEMat) a list of the Economic Policies consistently employed by Advancing-Economy nations.

Together, these two halves make a Strategic Plan (Aristotle’s “Right Plan”) for reliably advancing economies, incomes, and spending power – while we sleep.

Worthwhile Industries’ CAMPUSes build self-sufficient communities profitably in a sustainable approach that mitigates risk by targeting revenue in large low-barrier-to-entry markets.

Hanna-Barbera imagined that our Jetson families would work two-day work weeks and three-hour workdays; Automation is neither about denying we humans an income nor denying anyone their dream job. Rather, a mix of social supports and automation are meant to work together to prevent entire lives from being spent twisting light bulbs into assembly-lined refrigerators. That’s a good thing.

With government policy that supports change, we can now see a return to important culinary art, teaching music, and dance, building productive exports, restoring poetry and great literature, pursuing life-sciences research, exploration, discovery, and restoring humanity and freedoms to our civilization.

Ask a 20-year office worker or truck-driver “Are you ready for a change?“, and eight times out of ten, you are going to hear “If I can afford to – yes of course”.

Strategic Investment in interconnected renewable automation is a shift in thinking as beneficial as Henry Ford’s assembly line. It’s a shift that supports worthwhile and profitable industries at the same time that it also harvests the trillions of dollars in economic prosperity left on the table when our technology investments haven’t supported a Good Life for everyone.

When Investment Markets prosper at the same time that national Debt, Deficits, Unemployment, Incomes, and Trade Deficits are corrected, only then can they be considered sustainable – and Worthwhile.

CAMPUSES ARE ECONOMIC INJECTORS

LET'S TALK

Mailing Address:

First Canadian Place,

100 King Street West,

Suite 5700, Toronto,

ON. Canada M5X 1C7

Worthwhile Ventures Capital is a subsidiary of Worthwhile Industries Incorporated